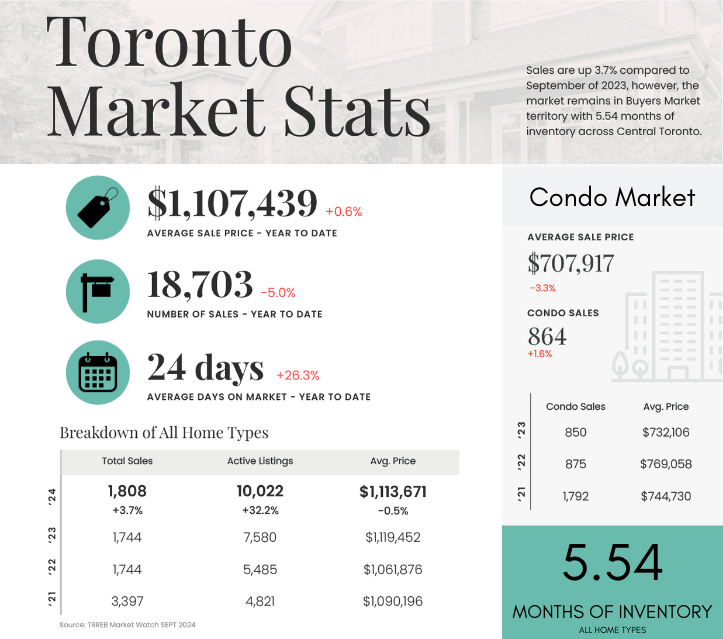

September went by in a flash and we are about a week away from Thanksgiving, fall will be over before we know it. The Greater Toronto Area housing market has begun to improve this September with home sales up 8.5% over the same month last year. Buyers are starting to take advantage of more affordable market conditions brought about by interest rate cuts and lower home prices.

The number of available homes for sale of all types increased by over 35% to 25,612, continuing the Buyers Market trend of over 5 months of available inventory. The average selling price, $1,107,291 was down by only 1% compared to September 2023's average of $1,118,215. On a seasonally adjusted basis, the average selling price edged up slightly compared to August.

The Toronto Regional Real Estate Board's Chief Market Analyst, Jason Mercer, stated that there continues to be a better-supplied market allowing for increased negotiating power for buyers re-entering the market. The ability to negotiate on price, led to moderate year-over-year price declines, particularly in the more affordable condo apartment and townhouse segments that are popular with first time buyers.

The prices of condominium apartments across the GTA declined slightly by 3.5% with sales remaining flat compared to September of last year. Resale condominiums and assignments(the sale of a contract of a newly or soon to be completed condominium unit that has not been registered) are where you can find good value in today's market. Should you be looking to make an investment in real estate please contact me as I would be happy to share more information in regards to these opportunities.

In mortgage lending news, some positive changes were announced last month by the Federal Government where existing mortgage holders will now have the ability to shop around for the best rate without facing a stress test, this will result in more affordable renewals. Further changes announced were the increasing of the $1 million price cap for insured mortgages to $1.5 million and the 30 year mortgage amortization options expanding to all first-time homebuyers and to all buyers of new builds, taking into effect on December 15, 2024 respectively.

I am always only a call, email or text away for all your real estate questions or needs, I look forward to connecting with you soon.